SUBHEAD:If energy is placed at the center of our economic worldview, its easy to predict that growth will stop.

Never has a society spoken so much about growth, yet achieved so little.

Time and time again predictions of recovery and a return to normal levels of economic growth have proven premature. The phrase “triple dip recession” has now entered the lexicon in the UK as GDP figures look like turning south again. One wonders how long it will be before quadruple, quintuple and sextuple dips take their place as common phrases to describe the UK’s mire.

With each announcement of GDP slippage, the news is delivered as somewhat of a surprise to politicians, economists and the commentariat in general. We’ve never had a high regard for journalists and politicians but economists on the other hand are deemed to be infinitely more sober and trustworthy. After all, they are the subject matter experts, armed to their teeth with teams of highly qualified forecasters and the very latest in advanced statistical models. Far too advanced for us mere mortals to understand, you hear!

Yet it is the economists who are the people who keep getting it wrong. Not all economists are cut from the same cloth, but the strand of economic dogma that graces our most prestigious institutions and has the ear of policy makers and the media is varyingly referred to here as the “mainstream” (other terms are available, including Neoclassical, traditional, orthodox, central tradition, and in its most ardent form: Chicago School).

It goes without saying that statistical projections of the future have margins of error. Therefore, the failure of standard macro economic forecasts to predict our repeated slumps is often attributed to these statistical errors (maybe with a few post-hoc rationalisations thrown in for good measure, such as that pesky weather we keep having).

But the very premise of statistical error is that on balance, errors are neutral. Therefore our real performance should turn out to occur higher than predictions as often as it turns out lower. Yet that’s not the way things have turned out, with many forecasts turning out to be over optimistic [1].

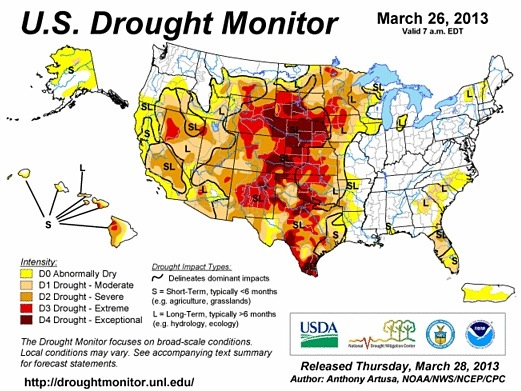

A recent chart from the IMF shows how there has been a general slowing of developed country (G7) growth since the 1990s. There is still some residual growth, but the trend in growth rate is clearly downwards. At the current trajectory the G7 economies risk being in constant decline from about 2015.

This is not what is written in the standard Neoclassical economists’ tea leaves. Economies are meant to bounce back to their “long run” trend of about 2-3% growth per annum (I put long run in quotes because this has only really happened in the last 200 years or so, and therefore not that long in proper historical terms). Hence there is the sign of at least some soul searching within macroeconomics.

), one major gap in macro-economic modelling is the failure to account for debt, money and banks, and bit by bit, the mainstream is starting to play catch-up [2].

2) A short history of growth theories

Ultimately, when one breaks it down, the main task of economics has attempted to answer two fundamental questions:

Where does economic growth come from, and how should we best allocate the proceeds of economic output?

The Neoclassical school believes it knows the answer to both these questions. Perhaps the clearest single expression of their “answer” is the Solow-Swann model of economic growth (

http://en.wikipedia.org/wiki/Neoclassical_growth_model). Of all macroeconomic theories this single model perhaps best encapsulates mainstream thinking on the subject. Whether from the political left or the right, the underlying foundation is the same. Growth is declared to derive from two main input factors, labour and capital, moderated by improvements in technological innovation.

Wages represent the share of contribution played by labour, whereas rents, profits and interest represent the contribution of capital (a conveniently slippery term if ever I saw one, but lets save that for another day). Therefore, if we want more growth, we just need to increase the quantity of labour and capital or the efficiency of either through technology.

But, what if this mainstream model of economic growth has an even bigger flaw in it, beyond the careless oversight of money, banks and debt? What if all standard economic growth models have no better grounding in reality than attributing progress to something like magic fairy dust and the power of mind over matter? What if they are nothing more than a set of arbitrary and flawed mathematical equations that can only exist on paper rather than the real world? What if they are actually ignoring and contradicting known laws of physics?

Well, it is no exaggeration to say that the standard Solow-Swann growth model (and its close relatives) is in fact a complete work of fiction. Statistical fiction. And to demonstrate this I will call in witnesses including the perpetually popular TV physicist Brian Cox, an obscure Nobel chemist from the early twentieth century, and the recent bemusement over the UK’s productivity decline. Together, they can all shed light on the West’s floundering growth situation.

But before we get into the statistical flaws, we need to journey back in time.

Our story of economic growth theories begins at around the start of the economic profession itself. Not with Adam Smith, but a few decades beforehand in 18th century France with a curious group who were known as the Physiocrats. Being just the cusp of the Industrial revolution, this was a time when a large proportion of people worked the land; i.e. agriculture, farming, lumber-jacking, and even mining.

To the Physiocrats all wealth originated with productive work on the land, as this is where the raw materials for subsistence living, industrial production and even extravagance were obtained (think palaces, fine clothing and jewellery).

Quesnay’s Tableau Economique (

http://en.wikipedia.org/wiki/Tableau_%C3%A9conomique) was developed in 1759 to show the linkage between various sectors of an economy. It clearly defined the inputs of one profession as being derived from the outputs of another. In Quesnay’s worldview, the economic process was explicitly represented as a means of transforming lower grade inputs into more useful and worthwhile outputs. All output ultimately traceable back to the original source of land based resources.

A key feature of this structure is that the transformations happen in one direction only, as the system can’t work in reverse (i.e. jewellery, fine clothing and palaces cannot in themselves make fruit grow). As their name implies, the Physiocrats were practical people, acknowledging the very real process of economic production; the fusion of manual efforts and raw inputs being converted into more useful and valuable states. Mankind as father, but earth as mother.

But as Europe (especially Britain) began to industrialise, the view of natural resources as key inputs began to wane. Adam Smith led the way in celebrating human ingenuity as the cause of wealth, mainly to fend off the growing popularity of Mercantilism (production for export and trade). Instead, specialisation and division of labour being deemed to create the new riches of increased productivity. Fast forward some 230 years and this human ingenuity argument is still at the centre of most explanations of the cause of growth.

We are told that mankind can unlock perpetual growth, provided the right prescriptions are followed; whether it is to let market forces unleash ingenuity, let the entrepreneur find new ways to innovate (i.e. Schumpeterian Creative Destruction), tear down trade tariffs (WTO), ensure a good education and legal system, stimulate demand through Government spending, promote a climate of business confidence etc. [3].

Instead of any link to the real process of production, through the Solow-Swan model we are submerged in the land of exchanges, transactions and substitutions which unlike the unidirectional Quesnay model, now take on the mathematical elegance of reversibility. Economic and monetary exchanges (e.g. trading) are reversible. A transaction in one direction can be undone. Substitutions of inputs are deemed to be perfectly feasible. If capital can substitute for labour, then labour can substitute capital (at the right price, of course!).

No longer do we have a unidirectional model of physical transformation, but instead the pompous exposition of mathematical elegance. In the mainstream view jewellery, fine clothing and palaces can in fact make fruit grow! This is the crowning glory of the marginalist method, where money and price are elevated to majestic reverence.

All must worship the ubiquitous social convention of monetary exchange; that pseudo-scientific expression of interpersonal trust that always commands us to do the most efficient thing. Extremely powerful stuff that trust, money and prices, but no more tangible really than magic pixie dust (each can vanish before your very eyes!). All effort has been taken to chase away the demon of physical reality, leaving our subjective preferences, choices, and the ether of trust that “powers” our economy. In their world one can milk a tractor as surely as a cow.

As well as the pre-eminence of reversible mathematics, it is clear that almost all mainstream theories of growth place mankind at the centre of things, whether as the heroic risk taking and entrepreneurial individual or as part of enlightened political and social structures. In some respects this appears quite justifiable. Are not these riches of man’s doing?

But if looked at closely, most explanations of what powers economic growth begins to veer into the paranormal when you witness economists invoking such unscientific explanations as sentiment, ingenuity, animal spirits and invisible hands. Abstract thought experiments are invoked to convey and substantiate their model of the way the world works. Evidence and reality seems to take a back seat compared to colourful rhetoric and zeal. This is quite a departure from the Physiocrats view.

And if it weren’t for the efforts of a small group of fringe economists and natural scientists, it might have gone entirely unnoticed.

3) Physics fights backs

In 1921 a Nobel Chemist called Frederick Soddy (best known for making major contributions to the discovery of radioactivity whilst working with Ernest Rutherford) held a series of lectures on Economics [4]. This was to later form the basis of a book published in 1926 called “Wealth, Virtual wealth and debt”.

Soddy began by asking how mankind lived; how we came to acquire the material riches of Industrial Development. In answer to that question, Soddy proclaimed that it is almost exclusively by sunshine. His explanation was based on following the energy / food chain that affects all living creatures. This energy chain was somewhat reprised recently in the first episode of Professor Brian Cox’s TV series “Wonders of Life”.

Here we are taken to exotic locations and shown elaborate computer graphics to convey the same point Soddy made 90 years ago in a comparatively sparse lecture hall in London.

Life forms take high grade energy from the external environment and use this to power themselves. The plant kingdom is the biological equivalent of solar panels, absorbing energy from the sun’s rays and creating complex sugars through Photosynthesis. A whopping 130 terra watts of energy is absorbed by 100% biodegradable, 100% recyclable, perfectly sustainable self-replicating “solar breeders” that also happen to look, smell and taste nice too! The animal kingdom takes its energy either from the plants, or from other animals in the form of food. Animals can’t directly acquire energy from the sun, but do obtain it indirectly.

As Prof Cox explains in his inimitable big budget way, the natural laws of physics state that order tends to flow into disorder; entropy being the term for disorder. The second law of thermodynamics explains why water can’t flow uphill and that given the arrow of time why (within a totally closed energy system) the normal tendency is for things to deteriorate to a lower grade of usefulness.

“Real wealth rots and rusts”, Soddy reminds us. Life on the other hand appears to contravene this process, but in reality this is only because it exploits high quality external energy, in the process creating a localised improvement in order (for the organism), but externally increased disorder (otherwise known as waste and pollution). At first glance it may appear that life is cheating the laws of physics (fighting the process of entropic degradation), but in totality it is not.

Life is merely a temporary parasite from an energy point of view; feeding off something or someone else for its personal use, and dumping less useful energy in its wake. Without the external energy source, there is no life.

But what has this little digression got to do with Economics? Professor Steve Keen (author of Debunking Economics) explains succinctly in a video lecture on the subject

(

http://www.youtube.com/watch?v=14vVhhNvWX0). The very process of economic production (whether manufacturing or service sector) involves a transformation against the natural tendency of things to break down or degrade. It isn’t scarcity per se that we value in economic exchange, but the superior arrangement of items in our world that wouldn’t necessarily occur automatically (i.e. without some form of anti-entropic intervention). It may not cost us much (in time or effort) to find an exquisite diamond in the ground, or millions of gallons of oil, but the processes of physics, chemistry and biology that created these were against the grain of natural degradation. The Steve keen video explains that production creates order from disorder and so must obey the second law of thermodynamics.

Therefore it must draw on energy inputs to fight against entropy. Production is the economic equivalent of Maxwell’s demon, creating order from chaos. An external energy source is the only way in which such a constructive transformation can take place without breaking the laws of physics. Just like life, from an energy point of view, economic production must be parasitic.

But surely energy on its own is useless without human intervention? True, but human intervention without an external energy source is even more useless. Again, we can turn to Soddy for clarity on the subject:

“Let me illustrate what I mean …. by asking what makes a railway train go. In one sense or another the credit for the achievement may be claimed by the so-called ‘engine-driver’, the guard, the signalman, the manager, the capitalist, or share-holder, or, again, by the scientific pioneers who discovered the nature of fire, by the inventors who harnessed it, by labour which built the railway and the train. The fact remains that all of them by their united efforts could not drive the train. The real engine-driver is the coal.”

To Soddy, all of those man-made initiatives were merely the catalysts, not the fuel of economic activity. They are the efficient cause rather than the material cause. To a chemist, the distinction is clear and profound. Each human intervention has the ability to trigger or constrain productive forces, but each was not the underlying power source of the economic activity. Ultimately it takes real energetic power to create economic activity, as order from disorder does not come freely, in perpetuity or via human will alone.

Mankind exploits energy already in existence (fossil fuels being historical solar energy in the form of decayed organic matter) because we can’t create it from nothing. However, the mainstream of economics would have us believe otherwise. For such an overtly materialistic society, one is confused why our economic models pay so little attention to the material world. Instead they are engaged in a self indulgent fixation with mental desires and abstract utility!

It is a shame that Soddy’s views on monetary reform seems to have been used as a way to undermine or distract from his profound insight and argument for a basis of economic growth that adhered to the laws of physics.

It would take until the early 1970s for a branch of economics to form that encapsulated the physical basis of economic growth. Beginning in earnest with Nicolas Georgescu-Roegen, whose dense written style and razor sharp mind seemed to be handled by ostracisation from the mainstream rather than direct confrontation [5].

Following in his footsteps, Herman Daly is perhaps the most long standing and potentially cogent of this new wave of Ecological Economists. A former World Bank chief economist, Daly articulates the fundamental flaw of Neoclassical growth models:

“This, of course, is the famous circular flow diagram, depicting the economy as a circular flow of exchange value between firms and households—as an isolated system in which nothing enters from outside nor exits to the outside. There is no ‘outside’, no environment. The economic animal has neither mouth nor anus—only a closed-loop circular gut—the biological version of a perpetual motion machine!”

http://www.csbsju.edu/Documents/Clemens%20Lecture/lecture/Book99.pdf

4) Deaf, dumb and blind kids

Mainstream economics sees resources and environmental impact as merely a subset of inputs and outputs. To them, the economy is in control and is the master, wheras Ecological Economists see it the other way around.

Georgescu-Roegen and Daly have spent 40 years directly challenging the Solow-Swann growth model both from this conceptual angle, but also on a very practical point too.

A key criticism was the way that the mainstream model only found a modest relationship between capital and labour with economic growth. It turns out that there is a major missing proportion of explanation in the mainstream model. Extra growth is occurring beyond the amounts explained by labour and capital. In statistical terms it is known as the residual error, and represents that part of the outcome in which the model fails to account for. In normal statistical applications this would be interpreted as a key weakness of the model.

Rather than accept this as a weakness or attempt to understand and measure the missing inputs that could account for this error, a sleight of hand was resorted to. Solow and others hastily used this residual as a way of declaring that this must be evidence of mankind’s increased technical prowess.

This is an evasive and elusive “gap” in the model. The shadow of something real, which with no more scientific prowess than a soothsayer, the economists have declared as substantive evidence of technical progress. How are we to know that this is a correct diagnosis? Is it falsifiable? How has it been measured? Do we know the size of it is correct?

How have we established whether it was not caused by something else? Are we to confidently conclude that technical progress can and will always add to growth? Or are the economic priesthood permitted to let this residual fluctuate with the seasons? Not only is this woeful statistical practice, but it is inherently poor science too.

Since 2007, Ayres and Warr have provided perhaps the best set of nails to drive into the coffin of the Solow-Swann model. They demonstrate that energy available for useful work by society provides a remarkably more satisfactory explanation and statistical fit, without having to resort to intangible and mystical concepts such as human knowledge and technology. This forms the basis of their Useful Work growth theory (

http://www.insead.edu/facultyresearch/research/doc.cfm?did=1244). But time and time again, these criticisms are ignored.

5) Wealth is, as wealth does

There is certainly a very strong correlation between energy usage and economic output, whether viewed in a cross-sectional form, or longitudinally.

The very embodiment of a wealthy country is its extravagance, whether in the form of elaborate infra-structure, high rise buildings, large houses, etc. All of which require substantial amounts of energy to build and maintain. Likewise, a highly wealthy individual has access to substantial energy resources at their personal disposal. Some if it is direct, in terms of a large and fuel hungry car (or yacht, or private jet!), whereas other times it is indirect, such as visiting nice restaurants and hotels.

Being able to command the services of others (who themselves require energy both to live and to fulfill their working duties) or the manufactured products of others is the very embodiment of wealth. We understand wealth as purchasing power, but this doesn’t mean purchasing power (in the form of money or credit) can create energy. So why don’t mainstream economists see the world this way too?

It seems that the two key objections raised to the Useful Work theorem are related to the low cost share of energy and in proving causation. The Cost Share argument goes all the way back to the mainstream Shibboleth about the contribution of inputs to economic activity being reflected by the share of expenditure.

The energy sector accounts for approximately 4% of UK GDP [7], so its contribution to the economy is deemed as no more or no less than this. But why must we accept this premise in the first place? Pure common sense demonstrates this to be flawed. Take running a car as an example.

The costs for putting fuel in the tank may only be about a third of the annual running costs (if one takes insurance, road tax, maintenance, servicing and depreciation into account), but that doesn’t mean that the fuel is only one third of the motive power. All those other costs may hinder your ability to use the car, but none of them propel it. Try running the car without any fuel ! Waving your insurance document around or any other amount of paperwork will not make it go.

The cost share argument is also deeply tautological. It starts with the premise that the cost share reflects contribution, yet it’s not entirely clear what the rationale or justification for this is! As energy has low cost share, ergo it must have a low contribution. But what if the price of energy changes rapidly? Does the cost share ebb and flow in tune to this?

We have seen oil prices more than triple recently. Does this mean that energy is now three times more important? If so, then what has changed so rapidly in the real world to make energy that much more important now that we have to pay three times more for it? Surely it still does broadly the same task.

More importantly, what if the supply of energy is reduced? Let’s assume that the cost share of energy remained at 4%, and then at a sudden point in time, energy supply halved. What would the mainstream model predict? If we follow their logic then we should only see a small dent in GDP, of the order of 2%. Of course, the price might change, and this may push up the contribution proportionately. But could it even entertain a dramatic impact on GDP in the way that an energy based model would?

Do we really think that our economy could function normally if energy inputs were halved? The mainstream model may suggest so, but a framework that better reflected Quesnay’s Tableau would spot the severity of the issue straight away.

Finally, the cost share premise is surely a deeply unsatisfactory method of prediction, for it allows the contribution to vary over time based on newly observed (therefore constantly changing) values. By its own admission it can’t predict anything because it retrospectively allocates the contribution of inputs! It is akin to Ptolemaic geometry where circles within circles are added when the evidence doesn’t match the prediction.

Rather then evaluate the underlying premise to see if the very principle of it is flawed, continuous tinkering is employed in a desperate attempt to try and salvage the overall model. Ever since Newton, science has prided itself on the accomplishments of formal predictive models with universal and permanent constants. In the mainstream economists’ world there are no constants.

The value of key parameters can drift up and down, akin to changing the laws of gravity as they go along. They are entirely free to move the goal posts after the ball has been kicked.

The second challenge to any energy based model involves the legitimate point that correlation doesn’t prove causation. This is certainly true, however the proponents of the importance of energy start with a plausible theoretical framework first. This is the laws of physics, as articulated by Soddy, Georgescu-Roegen and most recently Keen. This demands that useful work (i.e. economic activity) is powered by energy. It would be physically impossible to consider the causation the other way around.

Try “creating” energy but applying ingenuity, labour and capital. Surely each of these necessitates energy to begin with! We might use ingenuity to discover and exploit energy resources in our environment, but we haven’t made it from nothing. It would be highly egotistical for mankind to believe that he was the creator rather than just a mere curator of energy.

Despite the protestations from the mainstream about no proof of causation, the irony is that there doesn’t appear to be any plausible justification for why it could work the other way round. Yet the mainstream model has an embedded assumption of causality in which the mere act of ingenuity can bring forth energy and resources. In other words, humans can actually get something for nothing if they just apply themselves sufficiently. It is a bit like saying that if the world begins to suffer from a lack of energy inputs, it just isn’t trying hard enough to will it into existence. Clearly in their view, the human race is just not being optimistic enough.

The other claim is that we should just substitute energy for something else, like labour and capital, completely ignorant of the fact that reproduction of both these require energy in the first place. It’s as if mainstream economics went downhill some time after the Physiocrats and adopted anthropomorphic voodoo instead!

6) The revenge of reality

If, as the mainstream believes, energy and resource inputs (which undoubtedly would have some form of constraint on them in the near future [8]) are not critical inputs or can be substituted by other input factors, then we can all enjoy economic growth in perpetuity! That is the core presumption and consequent prediction of the mainstream model.

As a perfect example of this, the LSE’s recently released report from its Growth Commission resembles a glorious Technicolor celebration of the mainstream tenets of growth; labour, capital and technical innovation [9]. It is nothing short of a verbose exposition of the mathematical Solow-Swann formula for economic growth.

Each chapter of their exquisitely produced brochure is an assertive manifesto to harness each of these very human pillars as the elixirs of growth; human capital, man-made infrastructure and man’s abundant curiosity.

Not that these aren’t worthy aims in themselves. It is just that by resting on such overt hubris and narcissism, the gaping hole of how we power our existing way of life, let alone one of aspirational expansion, is summarily dismissed with a few cursory platitudes about making the right sort of investments in energy generation capacity.

By emphasizing the very human aspects of policy making, education, and the role of ingenuity, the LSE report provides a flattering sense of our self importance and potentially misleading long term prospects.

The report can be distilled into one simplistic and self-indulgent message: “permanent growth is ours for the taking, if we have the wisdom and the willpower to grasp it”. It is a technocrat’s wet dream.

Contrast this with the Limits to Growth (LtG) model first developed in 1972. This model commenced with a sensible framework of physical variables first and related linkages between them:

“Five variables were examined in the original model, on the assumptions that exponential growth accurately described their patterns of increase, and that the ability of technology to increase the availability of resources grows only linearly. These variables are: world population, industrialization, pollution, food production and resource depletion.”

http://en.wikipedia.org/wiki/The_Limits_to_Growth

There are no ethereal mental variables in this model. It is not based on abstract mathematical formulae or dubious cost share assumptions. In many respects it is a proper 20th century version of Quesnay’s Tableau pared down to the crucial inputs and outputs. There is no room for Deus Ex Machina explanations or post hoc rationalisations. There are variables that one might recognise as technical prowess, but this is a limiting factor (upper limit of maximum efficiency) not a source of productivity.

Unlike the Solow-Swann formula it has a mouth and anus. The LtG model shows an economy that has to feed off resources to grow. More importantly, the waste outputs of production (i.e. pollution) have a feedback loop with a delay to them. It attempts to incorporate the consequences of economic activity, something that is completely omitted from the mainstream model. Two recent reports show how its predictions using the standard model have fared well from 1970 to 2000 [10].

The critical aspect of the LtG model is the way that a major inflection point in food, services and industrial output per capita occurs once resource extraction peaks (estimated as somewhere between 2010-2015). In other words, once the fastest rate of exploitation has passed, living standards decline, and potentially decline rapidly (essentially halving in 20 years or so).

Mainstream economists may argue that their models have worked very well for the last 40 years, but only if we accept the fact that they were making constantly updated short range forecasts and we allow them to ignore all periods when they were wrong! In contrast LtG has remained a very good long range forecast. If its predictions continue to come true then we are indeed nearing the peak of world economic output, as well as hitting limits with food and other key resources.

The global economy may be facing a very serious risk of overshoot and collapse. Therefore two hundred years of compound growth is hitting up against physical limits that wit, wisdom and ingenuity alone cannot arrest.

As Steve Keen quipped;

“Only madmen and economists believe in infinite growth on a finite planet. Time we restricted it to just madmen.”

7) Withering growth, and withering growth thoeries

The traditional model and the predictions made by such hubristic prognoses could get severely tested in the next ten to twenty years. In fact there are already signs of it creaking now. We have faltering economies on every continent. Debt dynamics are not without blame, but Central banks and Government treasuries have been throwing the full policy toolkit at maintaining growth, and yet they cannot understand why it isn’t working. It is almost embarrassing to watch them fumble through these repeated failures.

The recent UK productivity riddle is one such example (

http://www.bbc.co.uk/news/business-19981498). Employment has slightly increased, yet GDP has stalled. How is this interpreted by the mainstream model? The explanation seems to require us accepting that productivity is declining. How can productivity, which has relentlessly improved for 70 odd years, start going backwards? How are we becoming less productive? We don’t lose technological skill as time progresses, we get better and better.

So how does the mainstream attempt to explain such riddles? The answer seems to come back as little better than declaring that technical progress and productivity always goes up, except when it starts going down! Post rationalisation emerges in abundance, along with token amounts of humility from the economic forecasters and the assurance of improved models going forward. This sort of shambolic amateurism would be laughed at in any other walk of life, yet economists still seem to retain a scientific aura.

But to truly qualify as scientists, they should be judged by the accuracy of their predictions; nothing more and nothing less. And their track record is going from bad to worse. Their models seem incapable of predicting stagnation let alone decline, so it is doubtful they will fare better in an increasingly constrained future.

However, if energy is placed at the center of our economic worldview, then we can make the following (testable) predictions:

a) Economies will struggle to substitute away from cheap fossil fuels without severe impacts on growth, as labour, capital and technical innovation cannot sufficiently replace energy (the impact will be far more severe than the cost-share assumption would predict)

b) In the face of increased costs of energy, and potentially constrained supply, many economies (especially the most developed) will struggle to maintain historical growth levels and will stagnate or even decline

c) Risk of political turmoil in struggling economies as the general public is confused and disappointed at weak economic prospects

d) There is an increased likelihood of social unrest, instability, military intervention and even wars in regions with remaining resources as countries compete over the dregs

e) Increased cost of food and water (even in the Developed West) as both rely heavily on cheap energy inputs as well as being highly vulnerable to pollution effects

f) Gradual decline in living standards for most of us (certainly reduced purchasing power, which will inevitably get diverted more towards essentials)

Undoubtedly, mainstream economists will continually resort to a rear guard action, as each new “surprise” requires some form of posthumous retro-fitting of continuous tweaks in a desperate attempt to cling on to their flawed foundations. But the cavalry of critics is growing in ranks. Reality seems to be getting in the way of the mainstream message and the cracks are getting wider. There have been many fringe contemporary critics on this subject, but there are now signs of this criticism reaching a wider acknowledgement. In the last 6 months there have been the following articles from within more mainstream circles:

- Martin Wolf of the FT refers to the peaking of industrial productivity [11]

- An IMF working paper postulates scenarios in which energy plays a more substantial role in economic growth [12]

- US Investor Jeremy Grantham warns that the days of abundant resources and low prices are over [13]

- A recent report called “Perfect Storm” released by Tim Morgan of Tullet Prebon Research warns of an increasingly volatile near future [14]

For the moment, whilst it still basks in unfounded limelight, mainstream economics remains stuck in its ways; clinging to its mathematical formalism. A formalism that is wonderfully elegant and flawless in every regard, except for the slight problem that it doesn’t actually reflect the real world. Undoubtedly, in the long run, reality will triumph. If only it were the flawed economic models that will wither in future, but regrettably, it is quite likely to be accompanied by the wholesale withering of Western economies too.

SOURCES:

[1] See Zerohedge on the damning level of cumulative GDP forecasts:

http://www.zerohedge.com/news/2012-12-10/sheer-comedy-erroneous-economist-gdp-forecasts-13-simple-charts

And figure 2 of this Federal Reserve report (pg 25), where far more errors over predict GDP growth (below the diagonal):

http://www.federalreserve.gov/pubs/feds/2011/201111/201111pap.pdf

[2] The Economist finally wakes up to the fact that alternate macroeconomic models might actually be more accurate at predicting crises:

http://www.economist.com/blogs/freeexchange/2012/12/reforming-macroeconomics

Whilst Noah Smith makes an interesting case about how macroeconomists (just like military generals) always seem to be fighting a previous war:

“Reading this, one could be forgiven for thinking that macro lurches from crisis to crisis, always trying to ‘explain’ the last crisis, but always missing the next one.”

http://noahpinionblog.blogspot.co.uk/2013/01/macro-always-fights-last-war.html

[3] The Wikipedia page on Economic Growth has a good summary of the main schools of thought on this subject:

http://en.wikipedia.org/wiki/Economic_growth#Theories_of_economic_growth

[4] “Cartesian Economics: The Bearing of Physical Science upon State Stewardship”

http://habitat.aq.upm.es/boletin/n37/afsod.en.html

[5] This is dealt with substantially in Herman Daly’s “Ecological Economics and the Ecology of Economics” (1999). A good summary is below:

http://www.capitalinstitute.org/blog/guest-post-not-production-not-consumption-transformation

[6] Source:

http://www.gapminder.org/world

[7] Source:

https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/65898/5942-uk-energy-in-brief-2012.pdf (pg 6). Incidentally the chart on pg 11 showing the rising share of energy imports for the UK is somewhat worrisome to say the least.

[8] A discussion of our energy predicament is way beyond the scope of this post, but useful reference sites are

www.theoildrum.com and ourfiniteworld.com. This report by Richard Heinberg is fairly comprehensive

http://www.postcarbon.org/new-site-files/Reports/Searching_for_a_Miracle_web10nov09.pdf

[9] The full report is available here:

http://www2.lse.ac.uk/researchAndExpertise/units/growthCommission/documents/pdf/LSEGC-Report.pdf

[10] “A comparison of the Limits to Growth with 30 years of reality”, Graham Turner

http://www.csiro.au/files/files/plje.pdf

“Revisiting the Limits to Growth After Peak Oil”, Charles Hall and John Day

http://www.esf.edu/efb/hall/2009-05Hall0327.pdf

Bear in mind that the LTG report wasn’t actually intended as a formal prediction. The authors were well aware that their parameter estimates may be wrong. Indeed they ran various scenarios making large changes to some of the parameters (the model structure remained the same). The conclusion at the time was that no matter whether we actually had more fossil fuels at our disposal or if we could be more efficient, and even if we could reduce pollution impacts the world was going to hit limits at some point. It was all a matter of timing and extent of overshoot.

[11] “Is unlimited growth a thing of the past”, Martin Wolf

http://www.ft.com/cms/s/0/78e883fa-0bef-11e2-8032-00144feabdc0.html

[12] “Oil and the World Economy: Some Possible Futures”, Michael Kumhof and Dirk Muir

http://www.imf.org/external/pubs/ft/wp/2012/wp12256.pdf

pg11 “Maintaining the system therefore requires the constant addition of a flow of energy.”

[13] Reproduced at:

http://www.theoildrum.com/node/7853

[14]

http://tullettprebonresearch.com/2013/01/21/perfect-storm-report-now-live/